I was still a child/teen during the inflation of the 1970s, so 2022’s inflation was brutal – the worst of my adult life.

Each grocery store trip last year was more alarming and disheartening than the last. Prices often rose between trips on the same items. According to the Agriculture Department, the cost of groceries rose by an average of 11.4 percent last year. But, of course, some people got rich off our collective budgetary pain – 62 new food billionaires were created during the pandemic, according to Oxfam America.

2023 is the year I try to restore some sanity to my food expenditures.

The pandemic caused a massive shift in my meal habits and food spending (and probably yours too). Pre-pandemic, I spent a lot on “food away from home” (FAFH). I grabbed a meal from Chipotle, Habit Burger Grill (loved those tempura green beans!), or Jersey Mike’s more often than I cooked something for myself at home.

That all ended in mid-March 2020. After the pandemic declaration, I immediately made a stock-up run at the nearest Costco and stayed in for several weeks. I didn’t set foot inside a fast-food, quick-service, or sit-down restaurant for over a year.

I formed new grocery shopping habits during the first six months of the pandemic: shop early, wear a mask, and get in and out as quickly as possible. Both Costco and the neighborhood Walmart Supercenter adopted “senior hours.” Sprouts Farmers Market didn’t have senior hours but was nearly empty on weekday mornings.

The savings from my home cooking quickly accumulated. I paid off my credit card debt and watched the cash accumulate.

That stockpile of cash made my Summer 2021 move to Austin possible. 1-800-GOT-JUNK? carted off most of the furniture in my Phoenix apartment. I moved just what I could fit in the cargo bay of my RAV4 – suitcases, totes, and a handful of boxes and containers. One morning, I got on Interstate 10, and I was in El Paso by that evening.

My 2020-21 “food at home” (FAH) savings made the move manageable, financing my Amazon orders and shopping trips to a Northwest Austin Target and Round Rock Ikea. July 2021, I furnished my new apartment from scratch – bed frame and mattress, pots and pans and kitchen equipment, sheets, linens, rugs, fans, a table, and a chair – and I immediately paid off the charges.

Then I anxiously watched prices skyrocket in 2022. By last fall, I was feeling helpless.

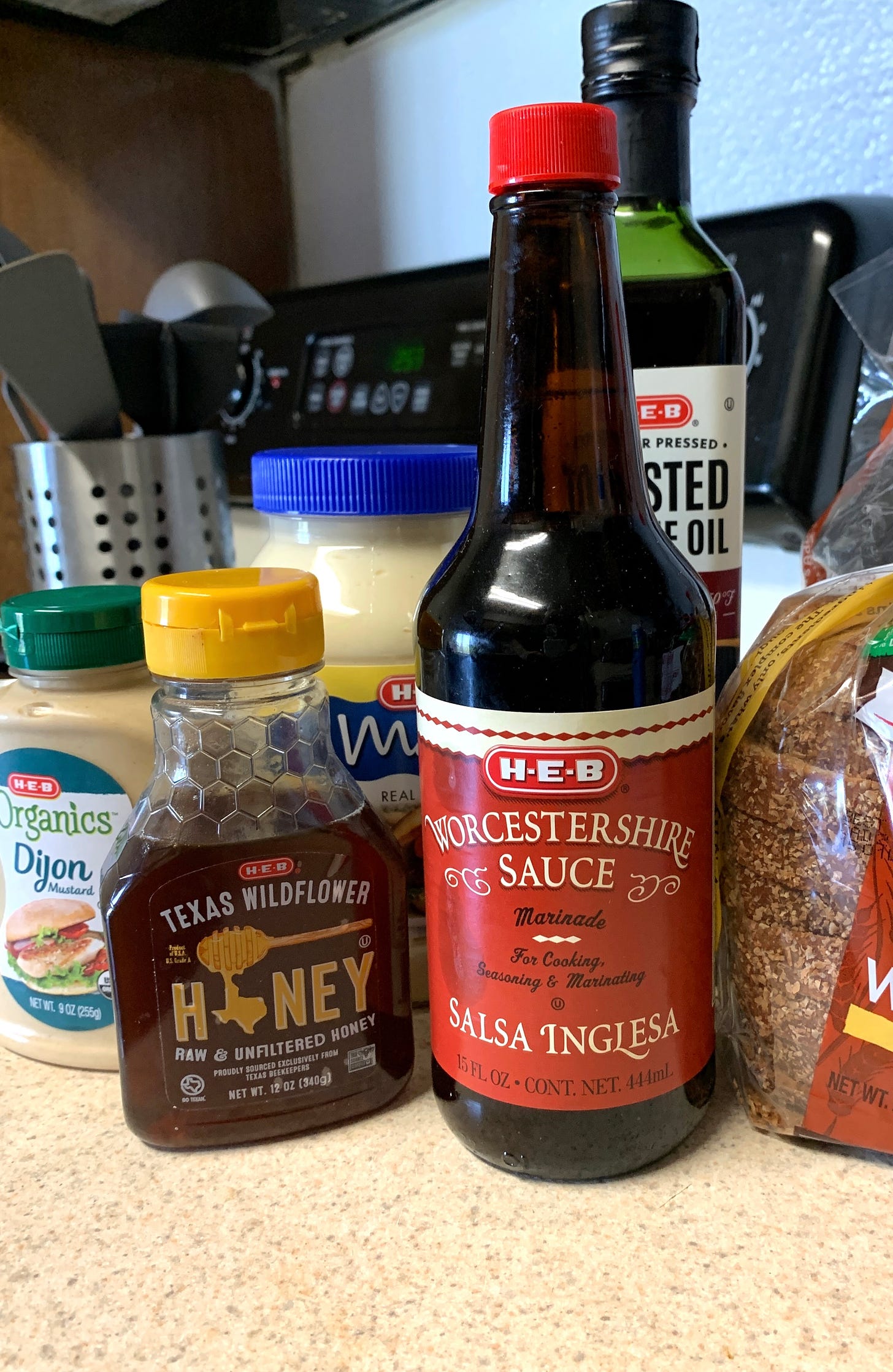

In December, Consumer Reports published a story on store-brand foods. For much of my adult life, I have bought name-brand products. However, the pleasant surprise after switching to store brands has been the high quality of H-E-B’s store-brand products.

H-E-B is a beloved Texas chain founded in the Hill Country town of Kerrville and headquartered in San Antonio. They’re primarily in the Austin, Corpus Christi, Houston, Laredo, and San Antonio areas, dominating the Central, East, and South Texas grocery markets. They have an Aldi-like discount chain, Joe V’s Smart Shop, a chain of Latino grocery stores, Mi Tienda, Wegmans-like upscale chain, Central Market, and a handful of True Texas BBQ counters in select H-E-B stores.

Store Brands

H-E-B’s “H-E-B” and “H-E-B Organics” products aren’t just good or very good; they’re excellent!

I prefer H-E-B’s mayonnaise over Best Foods/Hellmann’s and H-E-B Organics mustards over French’s, Gulden’s, and Grey Poupon.

Their “Pickle Me Dilley” branding may be too whimsical, but I prefer their pickles over Clausen, Mt. Olive, or Vlasic.

My all-time favorite bread remains Dave’s Killer Bread 21 Grains and Seeds, but H-E-B’s Essential Grains 100% Whole Wheat bread costs half as much.

The switch to private-label brands has been more revelation than sacrifice.

Then, of course, there’s Costco’s Kirkland Signature line. I’ve known for a while that most Kirkland Signature products are better than their name-brand counterparts.

What caught my attention in the Consumer Reports article about store brands was their “Where You Save the Most” chart. According to CR’s research, Costco store-brand products save you 51% over name-brand products – more than Aldi, Walmart, Target, or Dollar General0.

I’m running an experiment this year. After seeing the Consumer Reports article, I applied for a Costco Anywhere Visa. The credit card offers 4% cash back on Costco gas purchases (and EV charging), 3% cash back on restaurants and travel, 2% cash back on Costco warehouse and Costco.com purchases. Everything else is 1% cash back, but my Capital One Quicksilver card offers 1.5% cash back (Thanks, Samuel L. Jackson!).

I hypothesize that I can save on groceries by switching to Kirkland Signature products and paying for my annual membership with the Costco Visa cash-back rewards. The rewards are paid annually in February so that I won’t see the results of my experiment for a year.

What else?

I’m trying to bolster my home cooking skills:

I regularly check out ebook versions of cookbooks and capture the most exciting recipes into my “Food” notebook in Evernote. I’m happy if I can get 1 or 2 good recipes from each book.

I’ve been watching cooking and meal planning videos on YouTube – I learn something from every video on J. Kenji López-Alt’s channel, I need to make modifications to the Frugal Fit Mom’s advice as she’s shopping and cooking for a young family of 6 instead of an older person living alone, and while I find most of Joshua Weissman’s videos impractical, if entertaining, (that guy’s kitchen is way better equipped than mine), his But Better and But Cheaper videos often contain useful tips.

This Spring, I’m planning to “cook a book” like Julie Powell did in Julie and Julia – probably Molly Baz’s Cook this Book and then probably Samin Nosrat’s Salt, Fat, Acid, Heat (skimming the Salt section, of course).